Charles Hoskinson used a Feb. 6 livestream from Tokyo to push back on a familiar narrative he says he’s hearing on the ground in Japan: that Cardano is “fading” or “dead,” and that the bear market has drained the ecosystem’s momentum.

Speaking midway through a multi-city tour tied to Cardano’s third cohort of ambassadors, Hoskinson said long-time community members and newcomers alike have been approaching him with relief that the project is still active. He framed the trip as a signal that Cardano, after years of protocol work, is shifting into what he called a commercialization phase, building products that feel less like infrastructure demos and more like mainstream use cases.

Hoskinson Rallies Cardano Through The Downturn

“We’ve been on tour all throughout Japan,” Hoskinson said, describing meetings with “a lot of investors, a lot of developers,” including people who have followed Cardano “for more than 10 years.” The message he said he’s delivering is that major building blocks are in place: “The infrastructure is strong. We’re fully decentralized. Governance has been done. So now it’s the time to go build some fun, exciting, real use cases and get them into the ecosystem.”

Hoskinson name-checked Hydra, Cardano’s scaling effort, and pointed to projects he characterized as the “vanguard” of the next phase, including Midnight — the privacy-focused sidechain he has promoted as a cornerstone of Cardano’s broader roadmap. He also referenced “Starstream,” a WASM-based zero-knowledge virtual machine (zkVM) designed for the Cardano blockchain to enable private, scalable smart contracts.

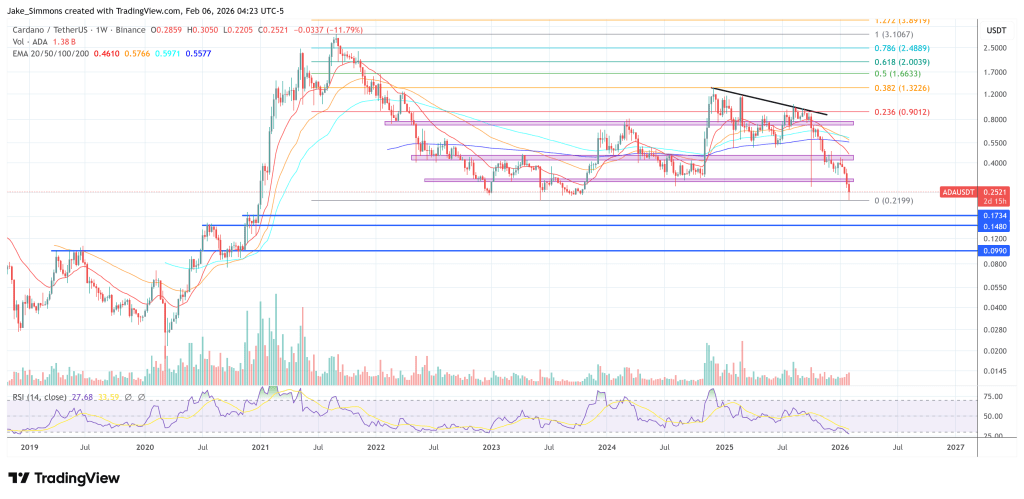

The backdrop, he acknowledged, is a market environment that “is red, red, red,” with sentiment weak enough that some attendees told him they had assumed Cardano’s best days were behind it. Hoskinson’s response was less a price defense than a thesis about why crypto persists through cycles and why he believes the longer-term direction of global finance makes open networks unavoidable.

“Globalism has finally reached its peak, accelerated by AI and accelerated by demographic changes,” he said. “The human race is starting to think in terms of we instead of nation by nation... And the old guard and the old way of doing things is fading. And they’re kicking and screaming as they’re being dragged off the stage.”

Red Days https://t.co/lO21fGjc0w

— Charles Hoskinson (@IOHK_Charles) February 5, 2026

He argued that a more integrated global economy ultimately needs a neutral settlement layer: an “economic franca,” in his words and that blockchain-based systems are the practical option. “The only way to run a world like this is through cryptocurrency. Full stop,” Hoskinson said. “Otherwise, you have to build an empire and no one’s strong enough to conquer the world right now... We need an economic franca. And you tell me how we’re going to do that without a blockchain.”

The livestream veered into broader institutional mistrust, with Hoskinson citing political instability, corruption, and high-profile scandals as evidence that “deep down inside, we all know this can’t last.” He cast crypto as a mechanism to constrain human behavior through “rules” and “regulating functions,” rather than relying on institutional goodwill.

But the most pointed moment came when he anticipated a common critique that his optimism is easy because he’s wealthy and responded with a personal financial claim and a commitment to keep building regardless of market outcomes:

“Every now and then you hear something like this, you say, ‘Yes, but it’s easy for you to say, Charles, you’re rich. You can ride it out.’ I’ve lost more money than anyone listening to this. Over $3 billion now. It would have been real easy to cash out. Just walk away. And do you think I honestly care if I lose it all? Do you think I’m doing this for money? You’re pretty mistaken if you do.”

Hoskinson also portrayed his distance from past industry blowups as a matter of personal discipline rather than luck. “There’s a reason I didn’t get rolled up in FTX,” he said, adding that his “default answer is no” when it comes to the kinds of deals that later become liabilities.

In closing, Hoskinson urged builders and community members to treat the drawdown as an endurance test rather than a verdict, tying Cardano’s ambassador programs, including a call to become a Midnight ambassador and engage via Intersect.

His core message was simple: the market may get “more red” but he isn’t leaving. “I’m here for life,” Hoskinson said. “As long as I’m alive, I’m just going to keep going.”

At press time, ADA traded at $0.2521.